Hey options traders and chart enthusiasts!

Today we're spotlighting some eye-popping options activity in 3M Company (MMM), coupled with a deep dive into its technical setup. Our Yusuke alert system has picked up on some seriously unusual volume, and the charts are telling an intriguing story.

🔍 The Alert Details

YUSUKE_ALERT $MMM 🏭

3M $134C 08/30/24 (2d)

Vol: 9,161 | OI: 228 | Vol/OI: 40.18

Total Premium: $230K

Executed At: 08/28/24 @ 09:07am

🧐 What's This Mean?

1. Massive Volume: With 9,161 contracts traded against an open interest of just 228, we're seeing a volume-to-open interest ratio of 40.18. This suggests a flood of new positions being opened.

2. Short-Term Bet: These calls expire in just 2 days, indicating traders are positioning for a very near-term move.

3. Bullish Sentiment: Call buying typically indicates bullish expectations. Someone's betting big that 3M could rally before Friday.

4. Significant Money on the Line: With $230K in total premium, this isn't small-time traders – this could be institutional money or someone with high conviction.

📊 Technical Analysis

Looking at the daily and weekly charts, we're seeing some interesting developments:

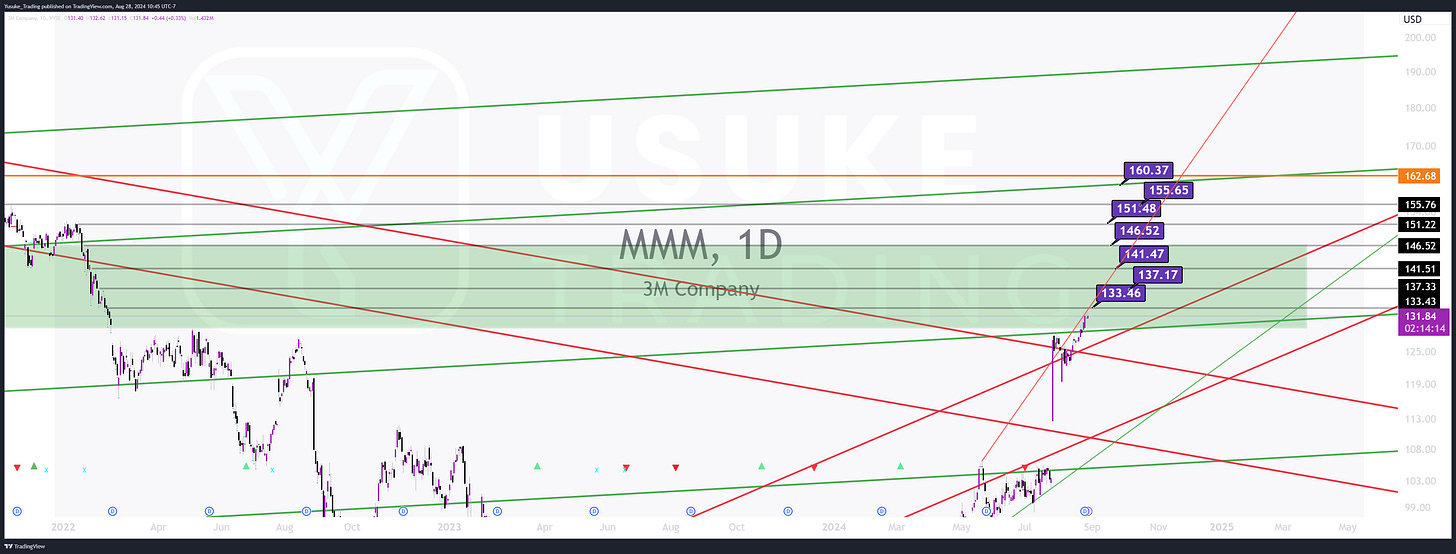

Daily Chart

- MMM is currently trading at $131.84, showing a bullish trend in the short term.

- The stock has broken above several key resistance levels, including $133.46 and $137.17.

- Next significant resistance levels are at $141.47 and $146.52.

- The stock is trading above its recent uptrend line, suggesting momentum.

Weekly Chart

- On a larger timeframe, MMM has been in a downtrend but is showing signs of reversal.

- The stock has recently broken above a long-term descending trendline, which is a bullish signal.

- Key resistance levels to watch are $141.56, $146.34, and $151.48.

- The stock is trading above its 50-week moving average, another bullish indicator.

🤔 Why 3M, Why Now?

The technical setup aligns with the bullish options activity we're seeing. Traders might be betting on:

- A continuation of the recent uptrend

- A break above key resistance levels

- A larger trend reversal on the weekly timeframe

Additionally, 3M has been in the news due to ongoing litigation issues. This options activity suggests some traders might be betting on positive developments or a technical bounce.

📊 What to Watch

Keep an eye on:

- The $137.50 level as immediate resistance

- Volume on any breakout attempts

- Any news that could act as a catalyst for the anticipated move

🚦 Trading Ideas

If you're bullish on 3M:

- Consider call options (but be aware of the high premiums due to increased demand)

- Look at bull call spreads to offset some of the premium costs

- Watch for a break and hold above $137.50 for confirmation of bullish momentum

If you're bearish or cautious:

- This could be a hedge against a short position, so watch for potential short covering

- Consider put options if you think this unusual activity is misguided

- Watch for a failure to break above $137.50, which could indicate a false breakout

Remember, always do your own research and never trade more than you can afford to lose!

---

That's all for now, traders. Keep your eyes peeled for more Yusuke alerts, and happy trading!

*Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always conduct your own due diligence before making any investment decisions.*

#OptionsTrading #MMM #YusukeAlert #TechnicalAnalysis #MarketIntel